36+ maximum deduction mortgage interest

Here is a simplified example with two instead of three mortgages. 2 minutes The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply.

See How Well Your Mortgage Interest Deduction Stacks Up Compared To The Rest Of The Country

Web are refinance fees tax deductible home refinance tax implications mortgage interest deduction refinancing mortgage interest deduction limit mortgage interest limitation.

. 15 2017 can deduct only the interest paid on up to 750000 or 375000 for married couples filing separately of. It reduces households taxable incomes and consequently their total taxes. A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest.

Web Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. Web March 4 2022 439 pm ET. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Lets start with the mortgage from 2016 with an average balance of.

Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages. For the 2020 tax year the standard deduction is 24800 for.

Web Taxpayers who took out a mortgage after Dec. Web HB 3010 limits Oregonians mortgage interest deduction from January 1 2024 to January 1 2028. Web The mortgage interest deduction has been around for more than 100 years but has changed over time.

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Homeowners who bought houses before. Discover Helpful Information And Resources On Taxes From AARP.

For taxpayers who use. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. Web Since 2017 if you take the standard deduction you cannot deduct mortgage interest.

Compare offers from our partners side by side and find the perfect lender for you. Different administrations have amended the rules for. Web IRS Publication 936.

Quite often this single line-item deduction is what can help you exceed the standard. Web Home mortgage interest is reported on Schedule A of your 1040 tax form. Web Yes of course.

Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Under the bill fifty percent of the estimated revenue increase. Web The mortgage interest deduction is a tax deduction that lets you reduce your taxable income by the amount of interest you paid on your mortgage during the tax.

Mortgage Interest Deduction A Guide Rocket Mortgage

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Mortgage Interest Deduction Rules Limits For 2023

Mortgage Interest Deduction Bankrate

Limitation On Home Mortgage Interest Deduction Tax Law Changes 2018 Youtube

How Is A Gift Perquisite Amount Taxed In India If It Is More Than 5000 Is The Entire Amount Taxed Or Just The Amount That Exceeds 5000 Quora

Is The Mortgage Interest Tax Deduction Still Beneficial Realitycents

Maximum Mortgage Tax Deduction Benefit Depends On Income

Mortgage Interest Deduction Bankrate

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

How To Maximize Your Mortgage Interest Deduction Forbes Advisor

Tax Assessment How Property Taxes Are Determined

:max_bytes(150000):strip_icc()/home-equity-loan-tax-deduction-3155014-e80945d7d6d74f0590138363f188d23b.png)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

Take The Full Deduction On Mortgage Interest Ahead Of The New Tax Law Accountingweb

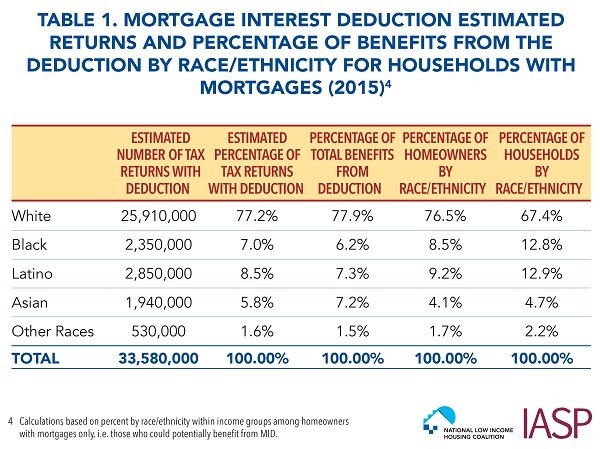

Race And Housing Series Mortgage Interest Deduction

Section 80ee Deduction For Interest On Home Loan Tax2win

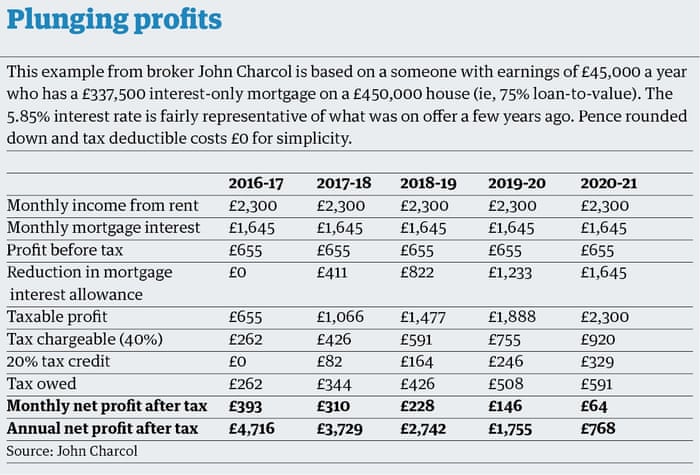

Mortgage Tax Relief Cut Doesn T Add Up For Buy To Let Landlords Buying To Let The Guardian