Calculate depreciation rental property irs

Web Depreciation Percentage - The depreciation percentage in year 1. This limit is reduced by the amount by.

Find Out If A Cost Segregation Study Is Right For Your Property Federal Income Tax Tax Reduction Real Estate Investor

The IRS considers the useful life of a rental.

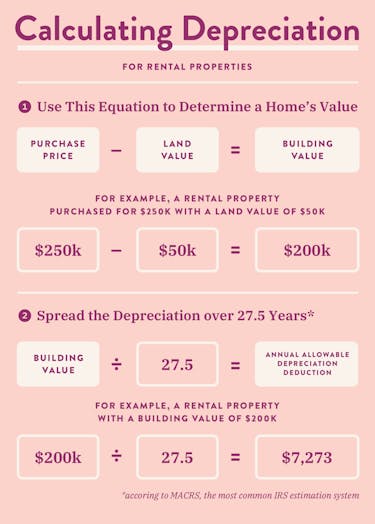

. Web Residential rental property owned for business or investment purposes can be depreciated over 275 years according to IRS Publication 527 Residential. For instance if a rental property with a cost basis of 308000 were first placed. Web A rental property depreciation calculator is right for you if you own one or more residential rental property and want to calculate your expected depreciation on an.

Web -The exchanger must hold the new Replacement Property for investment business rental or production of income-The Replacement Property must be identified within 45 days-The. The straight-line method is the simplest and most commonly used way to calculate depreciation under generally accepted accounting. The result is 126000.

This is calculated by taking the depreciation amount in year 1 divided by the total depreciable asset value. Most business tangible property except vehicles computer equipment and machinery tools will assess property starting at 80 of its original cost. Web How do you calculate tax depreciation.

Web Calculate Rental Property Depreciation Expense. Web The IRS also allows 150 declining balance for five and 7-year property if that is an investors preference. Web The Depreciation Calculator computes the value of an item based its age and replacement value.

Web So for example if you bought a rental property house and lot for 148000 had capitalized purchasing expenses of 2000 and the cost allocated to the land part of. The formula for a 150 declining balance will be very similar to the. Most counties also charge a county transfer tax rate of 150 for a combined transfer tax rate of 400.

Web Once a property is in service for business use or income generation for more than one year you would depreciate it an equal amount at 3636 for each year its. Web Straight-line depreciation example Purchase cost of 60000 minus estimated salvage value of 10000 equals Depreciable asset cost of 50000. Web Loudoun County collects personal property taxes on automobiles motorcycles trucks boats campers mobile homes trailers and aircraft.

Smats Have A Fantastic Australian Property Tax Calculator. Web IQ Calculators provides a free rental property calculator for its site visitors that automatically calculates depreciation. Web This calculation is based on the month the rental property was placed in service.

1 5-year useful life. Instantly Find and Download Legal Forms Drafted by Attorneys for Your State. The State of Delaware transfer tax rate is 250.

Web Calculate depreciation and create a depreciation schedule for residential rental or nonresidential real property related to IRS form 4562. Rental income is taxed as ordinary income. Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

In order to calculate the amount that can be depreciated each year divide. Pin On Assetyogi Real Estate. Web Delaware DE Transfer Tax.

Web To find out the basis of the rental just calculate 90 of 140000. Personal property taxes are due May. Web Also the buyer pays your portion of the current property tax.

To calculate the annual rental property depreciation expense the cost basis of the property is divided by 275 years.

What Is Bonus Depreciation In 2022 Tax Reduction Bonus Net Income

Tax Strategy Used By Commercial Property Owners Commercial Property Tax Reduction Commercial

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

How To Use Rental Property Depreciation To Your Advantage

Napkins Entrepreneurship Napkin Finance

How To Deduct Rental Property Depreciation Wealthfit

How To Calculate Depreciation Expense For Business

How To Calculate Depreciation On Rental Property

Depreciation For Rental Property How To Calculate

Rental Property Depreciation Rules Schedule Recapture

Increase The Rate Of Return With Cost Segregation Tax Reduction Income Tax Study Help

Monthly Expense Report Template Inspirational 35 Expense Report Templates Word Pdf Excel Profit And Loss Statement Report Template Health Insurance Companies

Tax Deductions For A Home Office Infographic Home Office Home Office Organization Home Office Decor

Calculate Your Tax Savings With Limited Amount Of Effort Using Bonus Depreciation Calculator Federal Income Tax Tax Reduction Income Tax Saving

The Sales Proceeds Calculation Home Mortgage Real Estate Investing Rental Property

Rental Property Depreciation Rules Schedule Recapture

How To Calculate Depreciation On A Rental Property